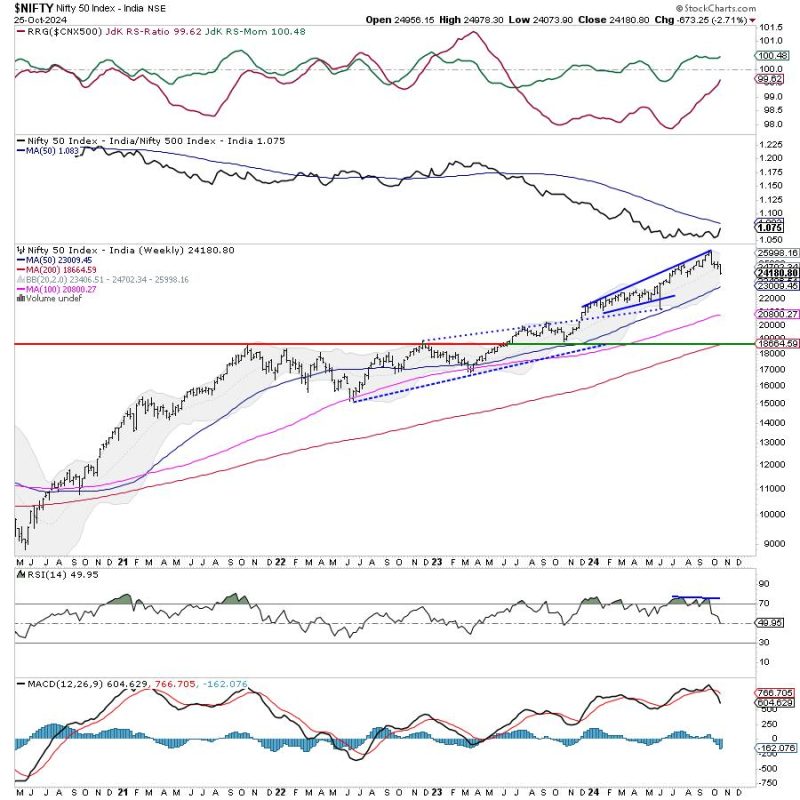

In the week ahead, Nifty has witnessed a significant drop, breaking through key support levels, causing resistance to move lower as well. The bearish momentum in the market has been evident as the index faces challenges to regain lost ground. With this development, investors are closely monitoring the market movements and preparing for potential scenarios.

One of the key factors contributing to the downward trend in the market is the prevailing uncertainty surrounding global economic conditions. The resurgence of COVID-19 cases, coupled with inflation concerns and geopolitical tensions, has sparked fears of a potential market slowdown. As a result, investors are adopting a cautious approach and adjusting their portfolios to mitigate risks.

In addition to external factors, internal market dynamics are also playing a significant role in shaping Nifty’s performance. The recent breach of key support levels has exposed vulnerabilities in the market, leading to increased selling pressure and a lack of clear direction. Traders and investors are closely monitoring technical indicators and market trends to identify potential entry and exit points.

Furthermore, sectoral performance has been divergent, with certain segments outperforming while others lag behind. This highlights the importance of sector rotation and the need for a diversified investment strategy to navigate market fluctuations effectively. As volatility remains elevated, risk management and prudent decision-making are crucial for investors to protect their capital and optimize returns.

Looking ahead, market participants are awaiting key economic data releases and corporate earnings reports to gain insights into the underlying fundamentals driving market movements. The upcoming weeks will likely be crucial in determining the market’s direction and the potential impact on investor sentiment. As uncertainties persist, staying informed, disciplined, and adaptable will be essential for investors to navigate the evolving market landscape successfully.