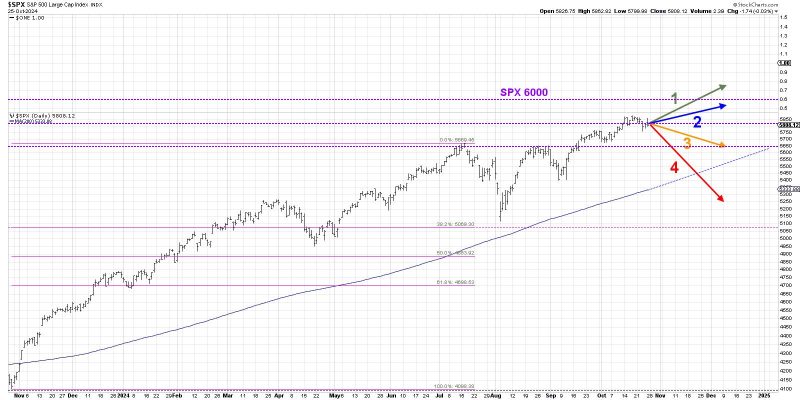

In a recent article on GodzillaNewz, the prediction that the S&P 500 won’t break the 6000 mark just yet has generated significant buzz in the financial world. While many investors have been eagerly eyeing the index’s climb, there are several reasons why the coveted milestone might remain elusive in the near term.

One key factor contributing to the hesitation around the S&P 500 hitting 6000 is the current state of the global economy. With ongoing geopolitical tensions, supply chain disruptions, and lingering uncertainties surrounding the post-pandemic recovery, investors remain cautious about the market’s ability to sustain such lofty valuations.

Additionally, inflation concerns have been looming large, casting a shadow over the prospects of a rapid ascent to the 6000 level. As central banks grapple with rising price pressures and the delicate balancing act of managing economic growth without triggering runaway inflation, market participants are bracing for potential headwinds that could dampen the index’s meteoric rise.

Furthermore, the specter of interest rate hikes by the Federal Reserve looms large over the market, with policymakers signaling their intent to gradually tighten monetary policy in response to mounting inflationary pressures. Such a move could potentially curb the exuberance in risk assets and weigh on the S&P 500’s upward trajectory.

Moreover, the market’s current valuations, while elevated, have prompted concerns about a potential correction or pullback that could stall the index’s march towards the 6000 level. With the price-to-earnings ratios of many equities at historically high levels, some market participants have sounded the alarm about a possible reckoning that could temper the index’s bullish momentum.

In conclusion, while the S&P 500’s ascent towards the 6000 mark remains a tantalizing prospect for investors, several hurdles stand in the way of a swift breakthrough. From economic uncertainties to inflationary pressures and the specter of interest rate hikes, the path to 6000 is fraught with challenges that could delay the index’s climb. As investors navigate these turbulent waters, a cautious approach and a keen eye on market developments will be crucial in managing risks and seizing opportunities in the ever-evolving landscape of global finance.