In the world of finance and trading, various indicators are utilized to gauge market sentiment and potential opportunities. One such indicator that is gaining traction in the financial community is the breadth indicator. This particular indicator provides valuable insights into market breadth, which refers to the number of individual stocks participating in a market move.

Market breadth is an essential component of market analysis as it helps traders and investors understand the underlying strength or weakness of a market trend. The breadth indicator essentially measures the number of individual stocks that are advancing versus declining within a given market index. By tracking this data, analysts can interpret whether a market move is being supported by a broad base of stocks or if it is limited to a few select securities.

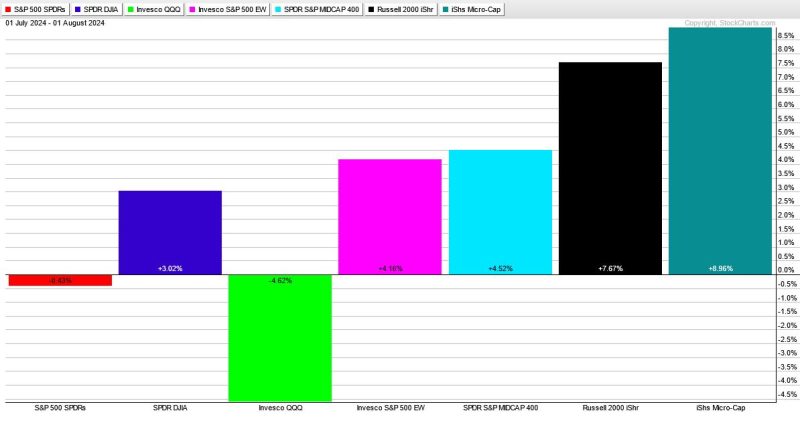

As highlighted in the article from godzillanewz.com, the breadth indicator is currently signaling the potential for more downside in the market. This suggests that the recent market rally may not be sustainable, as it is not being supported by a wide range of stocks. When market breadth is weak, it indicates that the overall market is less healthy and that the bullish momentum may be losing steam.

While a decline in market breadth can be concerning for investors, it can also present a potential opportunity for those who are vigilant and well-prepared. Market corrections and pullbacks are a natural part of the market cycle, and they can create attractive buying opportunities for investors looking to enter the market at more favorable valuations.

For traders and investors, understanding and incorporating market breadth analysis into their decision-making process can help them navigate volatile market conditions more effectively. By monitoring the breadth indicator and paying attention to shifts in market breadth, investors can gain valuable insights into market dynamics and adjust their strategies accordingly.

In conclusion, the breadth indicator serves as a valuable tool for assessing the health of the market and identifying potential opportunities for traders and investors. While a decline in market breadth may indicate more downside ahead, it can also present buying opportunities for those who are prepared. By staying informed and incorporating market breadth analysis into their trading strategies, investors can make more informed decisions and navigate market fluctuations with greater confidence.