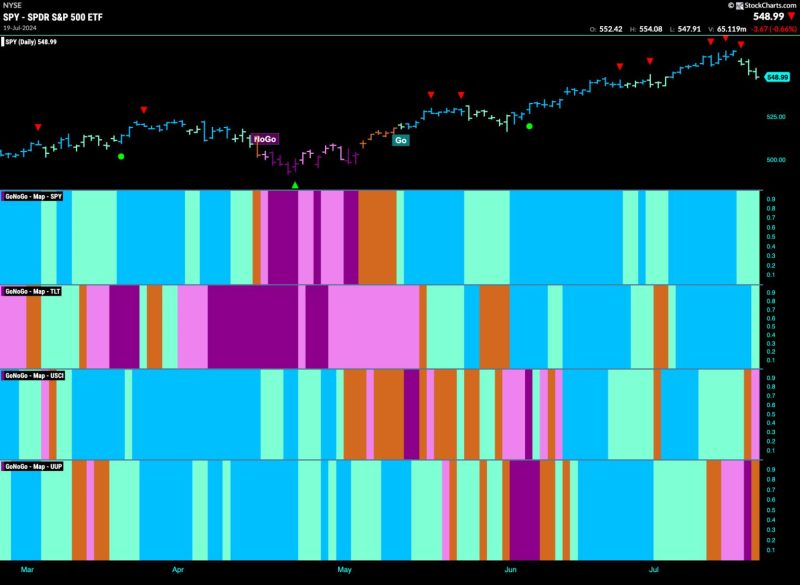

Financials Begin to Outperform as Equity Go Trend Weakens

The recent financial market trends are pointing towards a shift where financials are beginning to outperform while the equity market trend weakens. This shift is indicative of diverse factors at play in the global economy, signaling potential opportunities and challenges for investors and businesses alike.

One of the key drivers behind this shift is the changing economic landscape globally. With the ongoing geopolitical tensions and uncertain market conditions, investors are increasingly turning towards financial assets that are perceived as more stable and less volatile compared to equities. This flight to safety is boosting the performance of financial instruments, which are often seen as a safer bet during times of uncertainty.

Furthermore, the divergence in performance between equities and financials can also be attributed to the evolving regulatory environment. Regulatory changes and tightening restrictions in the financial sector are acting as a catalyst for innovation and growth within the industry. As financial institutions adapt to comply with new regulations, they are also exploring new revenue streams and business models, which are driving their outperformance in the market.

In addition, the changing consumer behavior and preferences are also influencing the performance of financials relative to equities. The rise of digital payment platforms, fintech companies, and alternative investment options is reshaping the financial landscape, attracting more investors and consumers towards financial products and services. This shift in consumer behavior is bolstering the growth trajectory of financial companies and enabling them to outperform traditional equity investments.

Moreover, the low-interest-rate environment globally is also playing a significant role in the relative performance of financials and equities. With central banks maintaining accommodative monetary policies to stimulate economic growth, financial institutions are benefiting from lower borrowing costs, which in turn, is boosting their profitability and performance in the market.

Nevertheless, despite the current trend favoring financials over equities, investors should remain cautious and vigilant. The market dynamics are constantly evolving, and unforeseen events or developments could impact the performance of financial assets and equities in the future. Diversification, risk management, and staying informed about the latest market trends are crucial for investors to navigate through the changing landscape and make informed investment decisions.

In conclusion, the shift towards financials outperforming equities is reflective of the multifaceted factors at play in the global economy. While the current trend presents opportunities for investors, it also underscores the importance of adaptability and foresight in navigating through the dynamic financial markets. With a strategic approach and a thorough understanding of market dynamics, investors can capitalize on the evolving trends and position themselves for long-term success in the financial landscape.