In recent times, the semiconductor industry has been a focal point of global economic developments, with its significance spreading across various sectors that rely heavily on technological advancements. The market for semiconductor products has been a dynamic one, characterized by shifts in demand, supply constraints, and evolving consumer behaviors.

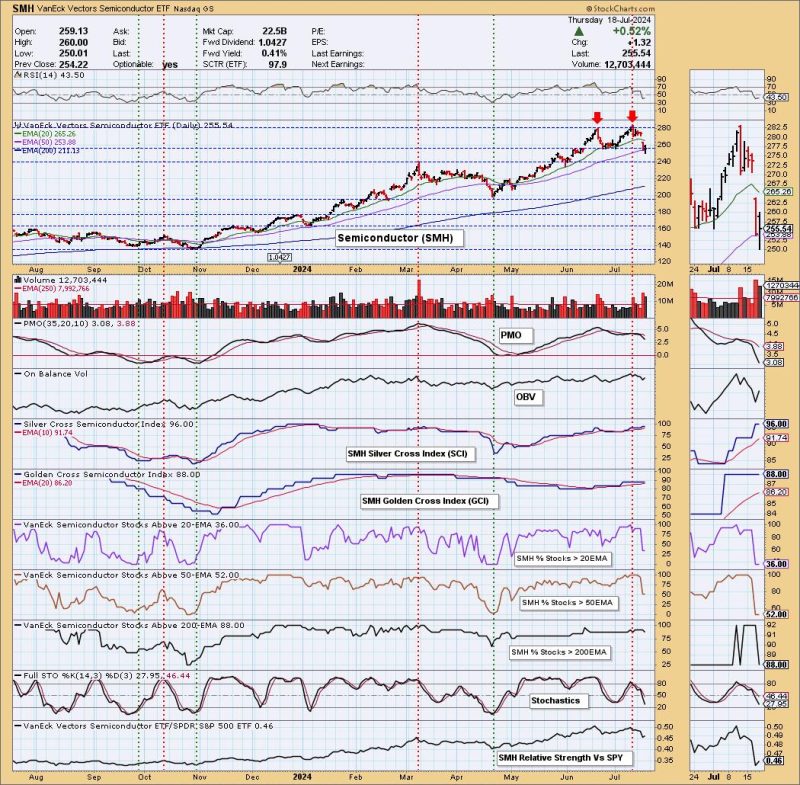

One prominent trend that has surfaced in the semiconductor industry is the emergence of double top patterns on semiconductor stocks, particularly on the SMH ETF, which tracks the performance of leading semiconductor companies. A double top pattern is a technical analysis pattern that signifies a potential reversal in the stock’s direction from bullish to bearish. This pattern is identified by two peaks at approximately the same level, separated by a trough in between.

When a double top pattern appears on the price chart of a semiconductor stock, it serves as a warning signal to investors and traders that the stock’s upward momentum may be losing steam, and a downward trend could be on the horizon. This pattern is often seen as a reflection of changing market sentiment and can trigger selling pressure as investors look to lock in profits or exit positions.

In the case of the SMH ETF, the double top pattern highlights the vulnerability of semiconductor stocks to external factors such as geopolitical tensions, supply chain disruptions, or shifts in consumer demand. These factors can weigh heavily on the semiconductor industry, impacting the performance of companies within the sector and influencing the broader market sentiment towards technology stocks.

It is essential for investors and traders to closely monitor the development of double top patterns on semiconductor stocks like the SMH ETF, as they can provide valuable insights into potential market trends and opportunities for strategic decision-making. By staying informed and vigilant, market participants can navigate the volatility of the semiconductor industry more effectively and position themselves for success in the ever-changing landscape of the technology sector.

In conclusion, the appearance of double top patterns on semiconductor stocks like the SMH ETF underscores the importance of technical analysis in evaluating market trends and predicting potential price movements. By understanding the implications of these patterns and their significance within the semiconductor industry, investors and traders can make well-informed decisions and adapt their strategies to the evolving market conditions.