With the Nifty displaying signs of exhaustion and potential profit-taking looming on the horizon, traders and investors must navigate the market with caution. The importance of identifying relative strength in such a scenario cannot be overstated. Recognizing which sectors or stocks are holding up well amidst broader market weakness can provide valuable insights for making informed trading decisions.

One key strategy during periods of market fatigue is to shift focus towards sectors or stocks that demonstrate relative strength. These are the areas of the market that are outperforming or holding up better than the broader market indices. By identifying such pockets of strength, traders can position themselves to capitalize on potential opportunities even in a challenging market environment.

A prudent approach is to conduct thorough research and analysis to identify sectors or stocks that are showing resilience in the face of market weakness. Tools such as comparative relative strength analysis can help in pinpointing potential outperformers. By comparing the performance of different sectors or stocks relative to the broader market, traders can identify where the strength lies.

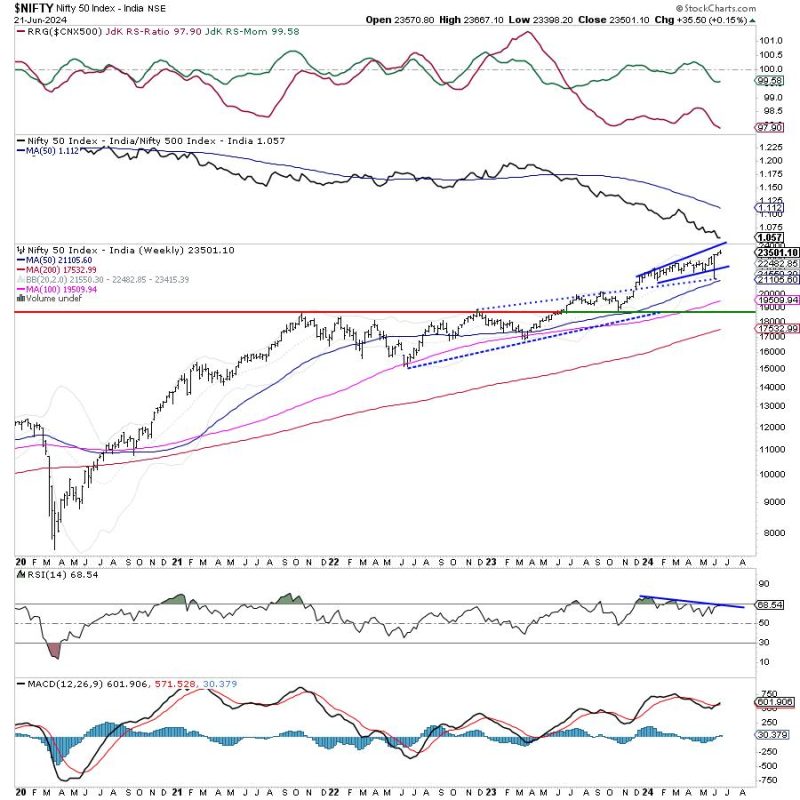

In addition to relative strength analysis, traders can also benefit from utilizing technical indicators to confirm and validate potential trading opportunities. Indicators such as moving averages, RSI, and MACD can provide valuable insights into the market dynamics and help in making more informed trading decisions.

Risk management is another crucial aspect to consider during times of market fatigue. Setting stop-loss levels and managing position sizes are essential to protect capital and limit downside risk. By implementing robust risk management strategies, traders can cushion potential losses and preserve their trading capital.

Furthermore, maintaining a disciplined approach and staying patient are key qualities that can help traders navigate through volatile market conditions. Emotions such as fear and greed can cloud judgment, leading to impulsive decision-making. By adhering to a well-thought-out trading plan and remaining disciplined, traders can avoid making hasty decisions driven by emotions.

In conclusion, with the Nifty showing signs of exhaustion and profit-taking on the cards, traders must remain vigilant and adapt their strategies accordingly. Identifying relative strength in the market can provide a competitive edge and unlock potential trading opportunities even in challenging market conditions. By conducting thorough research, utilizing technical indicators, implementing robust risk management, and maintaining discipline, traders can navigate through periods of market fatigue with confidence and resilience.