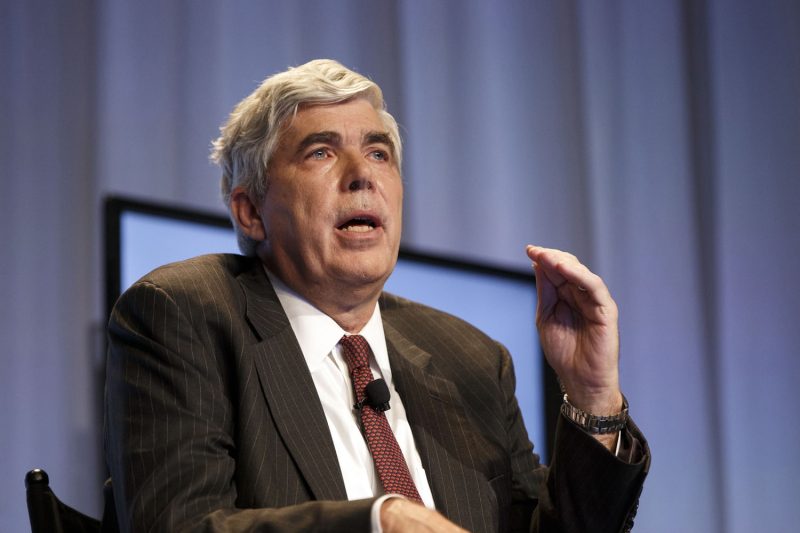

In a recent turn of events, Kenneth Leech, a former executive at Wamco, has been hit with charges of fraud by U.S. authorities. The allegations against him underline the seriousness of financial misconduct and the repercussions it can have on individuals and organizations alike.

The U.S. authorities have accused Kenneth Leech of engaging in fraudulent activities during his tenure at Wamco, a prominent company in the industry. The charges suggest that Leech exploited his position of power for personal gain, betraying the trust that was placed in him by the company and its stakeholders.

Fraud, in any form, is a severe violation of ethical standards and legal norms. The repercussions of fraudulent activities can be far-reaching, impacting not only the immediate victims but also tarnishing the reputation of the individuals involved and the organizations they represent. In the case of Kenneth Leech, the allegations of fraud have not only put his own reputation at stake but have also raised questions about the internal controls and oversight mechanisms at Wamco.

The charges against Leech serve as a stark reminder of the importance of transparency, accountability, and ethical conduct in the corporate world. Organizations must prioritize robust internal controls, regular audits, and clear ethical guidelines to prevent fraud and misconduct. Moreover, individuals in positions of authority must adhere to the highest standards of integrity and refrain from engaging in any activities that may compromise the trust placed in them.

As the case against Kenneth Leech unfolds, it highlights the need for vigilance and accountability in the business world. Fraudulent activities not only erode trust and credibility but can also have serious legal and financial consequences for those involved. It is essential for organizations to take a firm stance against fraud and corruption, ensuring that their employees act with honesty, integrity, and transparency at all times.