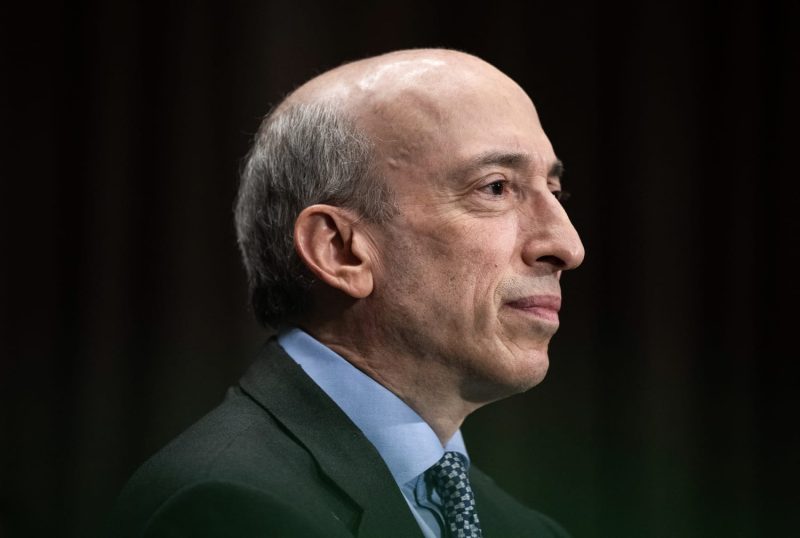

The sudden announcement of Securities and Exchange Commission (SEC) Chair Gary Gensler stepping down on January 20 has left many speculating about what the future holds for the regulatory body. Gensler’s tenure at the SEC was marked by a strong focus on investor protection and market integrity, with a particular emphasis on implementing stricter regulations for cryptocurrency and retail trading. While Gensler’s departure opens the door for a new leader, the possibility of a Trump-appointed replacement has raised concerns within the financial industry.

Gensler’s time at the SEC was characterized by his proactive approach to regulating the rapidly evolving landscape of finance. Under his leadership, the SEC took significant steps to address a range of issues, from the GameStop trading frenzy to the rise of decentralized finance (DeFi) platforms. Gensler’s background as a former Goldman Sachs banker and Commodity Futures Trading Commission (CFTC) chairman provided him with a unique perspective on the intersection of traditional finance and emerging technologies, making him a strong advocate for bringing regulatory clarity to the crypto space.

As Gensler prepares to step down, the focus now shifts to his potential replacement. With the possibility of a Trump-appointed SEC chair on the horizon, concerns have been raised about the direction the regulatory body may take. During his presidency, Donald Trump often criticized regulations that he believed stifled economic growth, leading to speculations that a Trump-appointed SEC chair could roll back some of the reforms implemented under Gensler’s leadership.

However, it is essential to remember that the SEC is an independent regulatory agency, intended to operate free from political influence. While the appointment of a new chair by the Biden administration could bring about a change in regulatory priorities, the core mission of the SEC remains unchanged: to protect investors, maintain fair and orderly markets, and facilitate capital formation.

Whoever succeeds Gensler as SEC chair will inherit a complex and dynamic regulatory environment, with challenges ranging from the proliferation of meme stocks to the increasing adoption of blockchain technology. The role of the SEC chair is crucial in shaping the future of finance and ensuring that the capital markets remain transparent and efficient in the face of rapid technological innovation.

In conclusion, Gary Gensler’s departure from the SEC marks the end of an era characterized by a strong focus on investor protection and regulatory reform. As the search for his replacement begins, the financial industry will be closely watching to see who will helm the SEC next and how they will navigate the evolving landscape of finance. The legacy of Gensler’s tenure will undoubtedly leave a lasting impact on the SEC and the broader financial regulatory framework for years to come.