Investing in Chromium Stocks: A Deep Dive

Understanding the Chromium Market

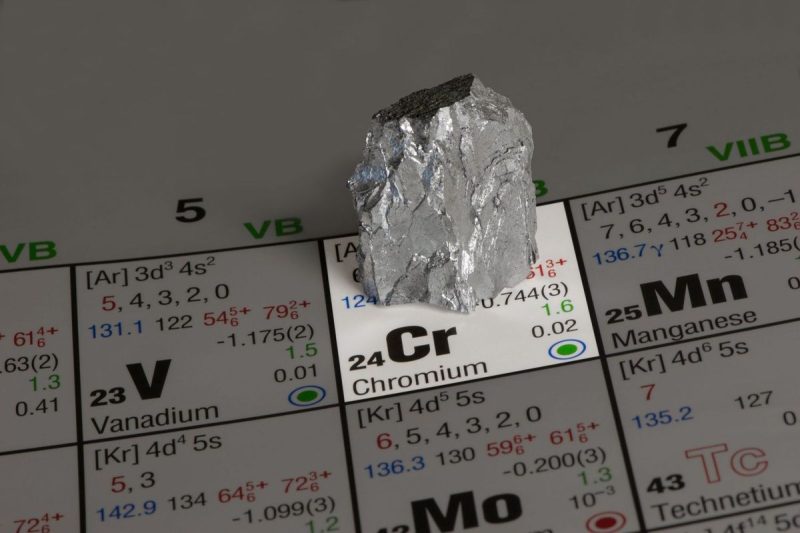

Before delving into investing in chromium stocks, it’s crucial to understand the chromium market. Chromium is a versatile metal used in various industries such as automotive, aerospace, and construction. Its anti-corrosive properties make it essential for manufacturing stainless steel, a widely used material. The demand for chromium is influenced by global economic conditions, infrastructure development, and technological advancements.

Factors Affecting Chromium Prices

Several factors impact the price of chromium, making it a volatile commodity to invest in. The supply and demand dynamics play a significant role in determining chromium prices. Political instability in chromium-producing countries, trade policies, and environmental regulations can also affect the market. Investors need to stay informed about these factors to make informed decisions when investing in chromium stocks.

Types of Chromium Stocks

Investors looking to enter the chromium market can choose from various types of chromium stocks. Mining companies that extract chromium ore are one option, offering exposure to the raw material. Alternatively, investing in stainless steel manufacturers or companies that produce chromium-based products can provide indirect exposure to the chromium market. Analyzing the financial health, market position, and growth prospects of these companies is crucial before making investment decisions.

Market Trends and Projections

Keeping abreast of market trends and projections is essential for successful chromium stock investing. Industry reports, analyst forecasts, and economic indicators can provide valuable insights into the chromium market’s trajectory. With the rising demand for stainless steel in developing economies and technological advancements driving innovation in chromium-based products, the long-term outlook for chromium stocks remains positive. However, investors should exercise caution and conduct thorough research before committing capital.

Risk Management Strategies

As with any investment, managing risks is vital when investing in chromium stocks. Diversifying your portfolio across various chromium-related companies can help mitigate risks associated with individual stocks. Setting stop-loss orders, staying informed about market developments, and regularly reviewing your investment strategy are key risk management practices. Additionally, considering hedging strategies or consulting with a financial advisor can provide added protection against market volatility.

Conclusion

Investing in chromium stocks can offer lucrative opportunities for investors seeking exposure to the industrial metal market. By understanding the chromium market dynamics, staying informed about price influencers, and carefully selecting investment options, investors can navigate the complexities of the chromium sector effectively. With a strategic approach, prudent risk management, and continuous monitoring of market trends, investors can capitalize on the growth potential of chromium stocks while managing associated risks.