Biotech stocks have long been known for their volatility and sensitivity to market trends, but recent indicators are pointing towards a potential downturn in the sector. The emergence of a dark cross neural signal has investors on edge and has triggered a cascade of negative effects on biotech stocks across the board.

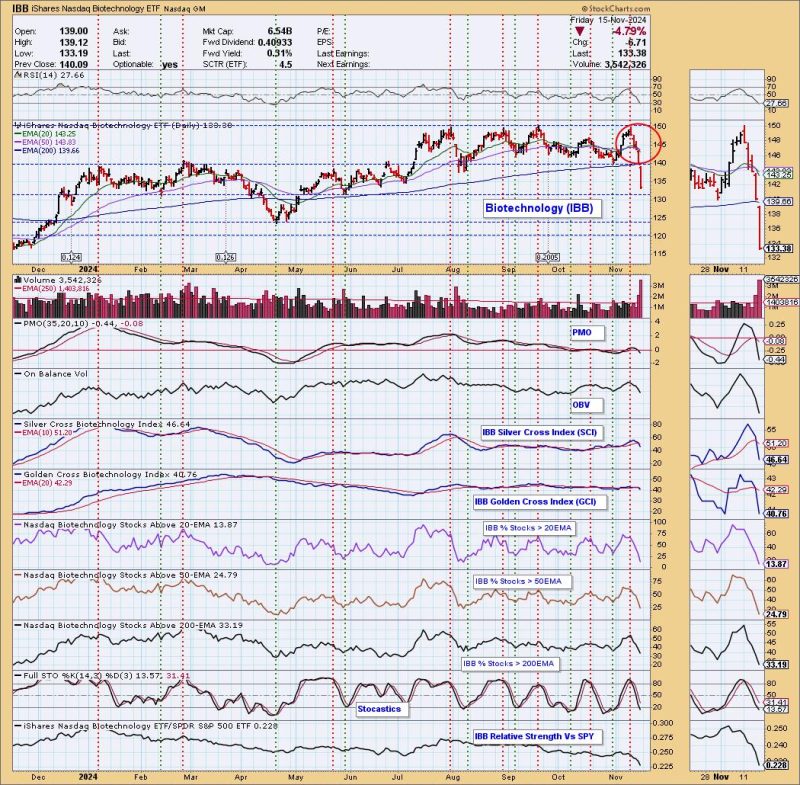

The term dark cross refers to a bearish technical pattern in a stock’s chart when the short-term moving average crosses below the long-term moving average. This signal is seen as a reversal of the previous uptrend and a potential indicator of further declines in the stock’s price. In the case of biotechs, the appearance of a dark cross neutral signal is often viewed as a warning sign for investors to proceed with caution.

Historically, biotech stocks have been subject to wide fluctuations in price due to the unpredictable nature of drug development, regulatory approvals, and patent challenges. As a result, investors in the sector are accustomed to weathering storms and capitalizing on market opportunities. However, the current dark cross neutral signal has sent shockwaves through the biotech industry, leading to a widespread selloff and erosion of investor confidence.

In addition to the technical signals, there are fundamental factors at play that are contributing to the weakness in biotech stocks. Uncertainty surrounding healthcare policy, drug pricing regulations, and the impact of the ongoing pandemic on clinical trials have all weighed on the sector. As a result, investors are fleeing biotech stocks in search of safer investments, putting further downward pressure on prices.

Despite the challenges facing biotechs, there are some potential silver linings for investors willing to weather the storm. The long-term prospects for many biotech companies remain strong, with innovative therapies in development and a growing demand for breakthrough treatments. For value investors with a high risk tolerance, the current downturn in biotech stocks may present an attractive buying opportunity to capitalize on oversold conditions and future growth potential.

In conclusion, the appearance of a dark cross neutral signal in the biotech sector is a sobering reminder of the inherent risks and uncertainties that come with investing in healthcare stocks. While the near-term outlook may be clouded by negative technical indicators and macroeconomic headwinds, astute investors who are diligent in their research and risk management may find opportunities to profit from the eventual recovery and resurgence of biotech stocks in the future.