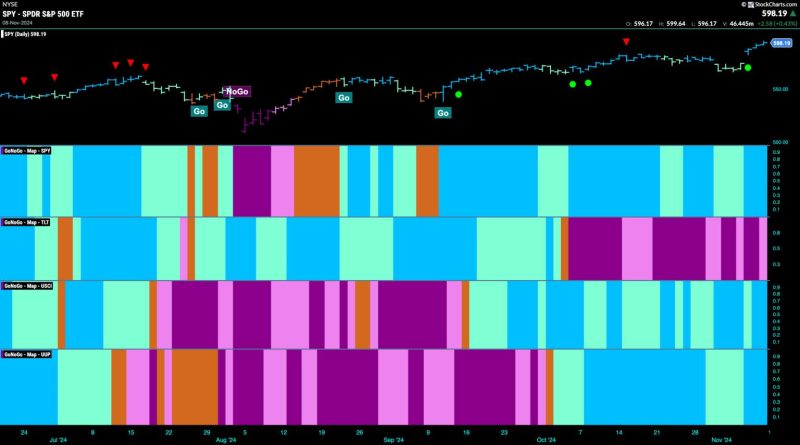

Equity GO Trend Sees Surge in Strength as Financials Drive Price Higher

The equity market has been experiencing a notable surge in strength in recent months, with the Equity GO trend leading the way. This surge is primarily being driven by the strong performance of financial sector stocks, which have been on the rise due to improving economic conditions and positive investor sentiment.

Financial sector stocks, including banks, insurance companies, and investment firms, have been among the top performers in the equity market in recent months. This strong performance can be attributed to several key factors, including rising interest rates, increased consumer spending, and a generally positive outlook for the economy.

One of the main drivers of the surge in financial sector stocks is the rise in interest rates. As interest rates have increased, financial institutions have been able to earn higher profits on their lending activities, which has resulted in a boost to their stock prices. In addition, rising interest rates are typically seen as a sign of a healthy economy, which has helped to bolster investor confidence in financial sector stocks.

Another factor contributing to the strength of the Equity GO trend is increased consumer spending. As the economy has improved and consumer confidence has risen, consumers have been more willing to spend money, which has benefited companies in the financial sector. Banks and credit card companies, in particular, have benefited from increased consumer spending, leading to higher stock prices for these companies.

Overall, the strong performance of financial sector stocks has been a major driver of the surge in the Equity GO trend. As economic conditions continue to improve and investor sentiment remains positive, financial sector stocks are likely to remain strong performers in the equity market. Investors looking to capitalize on this trend may want to consider adding financial sector stocks to their portfolios to take advantage of the potential for further gains in the coming months.