The article provided in the link discusses a short-term bearish signal observed in the markets as investors brace for a week filled with important news events. This signal suggests a cautious sentiment among market participants as they await significant announcements that could potentially impact various sectors and asset prices.

One key aspect that the article emphasizes is the importance of staying informed and being prepared for potential market volatility during such news-heavy weeks. This volatility could stem from a variety of sources, including economic data releases, corporate earnings reports, geopolitical developments, and central bank decisions.

An essential point to consider during periods of heightened news flow is the potential for sudden shifts in market sentiment. This can lead to sudden price movements and increased trading activity as investors react to new information. Traders and investors are advised to remain vigilant and closely monitor relevant news updates to adapt their strategies accordingly.

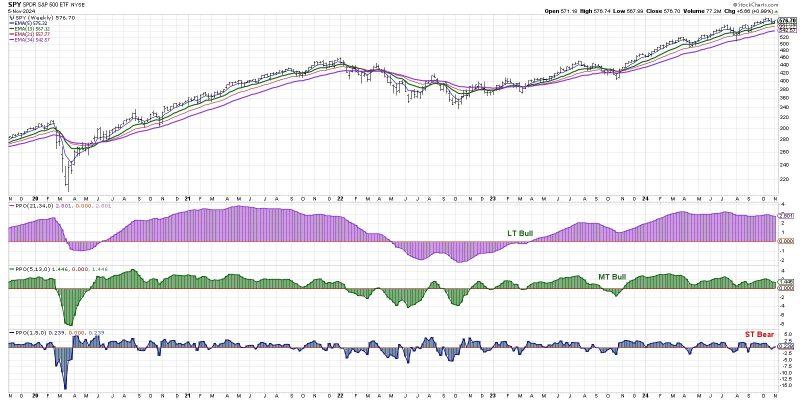

Moreover, the article touches upon the significance of technical analysis in interpreting market trends during uncertain times. By analyzing price charts and key technical indicators, traders can gain insights into potential market direction and make informed decisions based on solid data.

Additionally, the article suggests that diversification and risk management are crucial elements in navigating volatile market conditions. By spreading investments across different asset classes and employing proper risk mitigation strategies, investors can better protect their portfolios from unforeseen events and market fluctuations.

Overall, while the short-term bearish signal may be a cause for concern, it also serves as a reminder for market participants to exercise caution and prudence in their trading decisions. By staying informed, utilizing technical analysis, diversifying portfolios, and managing risks effectively, investors can better position themselves to weather market uncertainties and make sound investment choices in the face of upcoming news-heavy events.