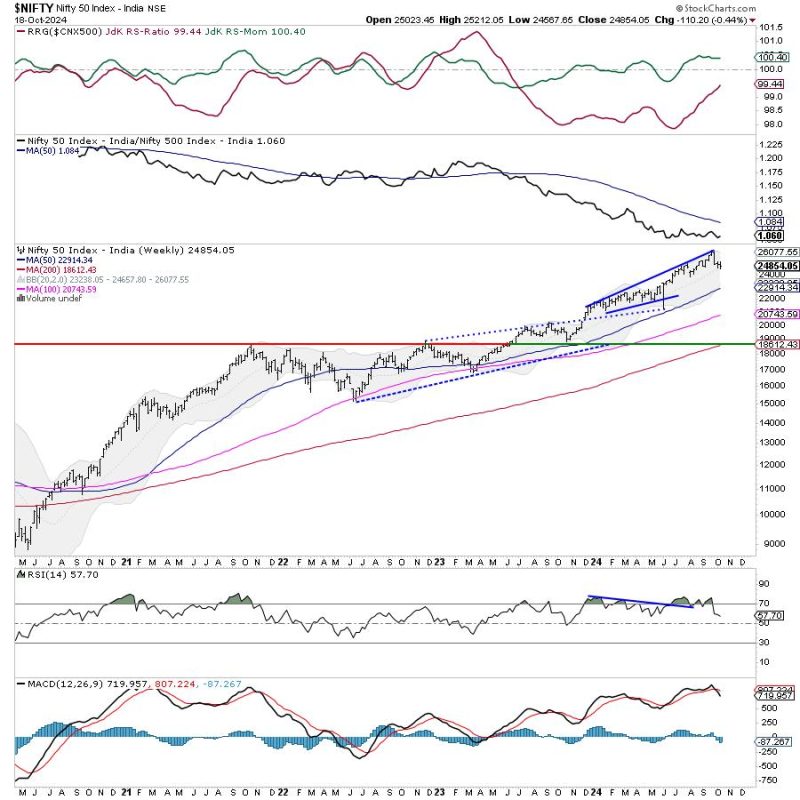

In the world of stock markets and trading, predictability is often the key factor for successful transactions. In the current scenario, the Nifty is expected to maintain a range-bound pattern in its movements over the coming week. Only if certain key levels are breached can we anticipate any significant shifts towards trending movements.

Technical analysis plays a vital role in forecasting market movements. Traders and investors keenly watch support and resistance levels on charts to make informed decisions. These support and resistance levels act as boundaries within which the market typically remains contained. When these boundaries are breached, it often signifies a potential change in market sentiment or trend direction.

For the upcoming trading week, it is crucial to monitor the key support and resistance levels on the Nifty index. These levels act as critical markers for determining possible future price movements. Traders are advised to keep a close watch on these levels and be prepared to adjust their strategies accordingly.

Breaking through the resistance level indicates bullish sentiment in the market. It suggests that buyers are in control, and the market may see an upward trend. Conversely, breaching the support level indicates bearish sentiment, with sellers gaining dominance and the market potentially trending downwards.

In the absence of breaching these key levels, the market is likely to remain range-bound, with limited directional moves. Traders operating in such conditions may employ strategies like range trading or scalping to capitalize on short-term price fluctuations within the established range.

Risk management is paramount in trading, especially in uncertain market conditions. Traders should set stop-loss orders to limit potential losses in case the market moves against their positions. Additionally, controlling position sizes and leveraging risk-reward ratios can help enhance overall trading performance.

Market volatility can present both opportunities and risks for traders. Keeping a watchful eye on important levels and being adaptable to changing market conditions are essential skills for navigating the stock market successfully. By staying informed and following a disciplined trading approach, traders can position themselves to capitalize on potential opportunities and mitigate risks in the market.