Equities Remain in ‘Go’ Trend and Lean Into Energy

Equities across the board continue to demonstrate strength as traders and investors lean into the energy sector for further growth potential. With market dynamics constantly shifting alongside geopolitical events and economic data, staying ahead in the equity markets requires a mix of vigilance, strategic thinking, and adaptability.

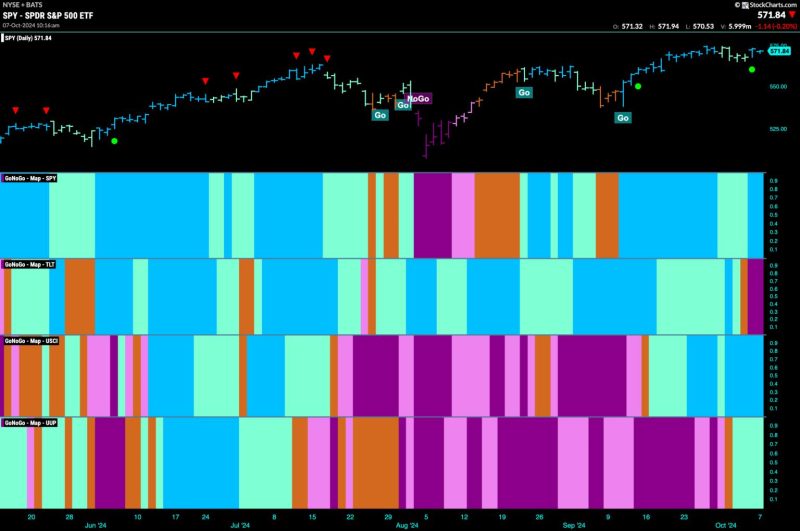

The current market stance seems to favor a ‘go’ trend, indicating that investor confidence remains high. A ‘go’ trend typically indicates positive momentum in the market, supported by favorable economic conditions and strong corporate performance. The energy sector, in particular, has emerged as a focal point for many investors looking to capitalize on rising demand and shifting dynamics within the industry.

One of the primary drivers behind the optimism surrounding the energy sector is the increasing focus on renewable energy sources and sustainability. As the world transitions towards a greener future, companies involved in renewable energy production, energy storage solutions, and clean technologies are attracting significant attention from investors.

Furthermore, the recent surge in commodity prices, including oil and natural gas, has provided a tailwind to energy companies, boosting their revenues and profitability. The recovery in demand post-pandemic, coupled with supply chain disruptions and geopolitical tensions, has led to a favorable pricing environment for energy producers.

Investors looking to capitalize on the energy sector’s growth have several options at their disposal. Traditional energy companies such as oil and gas producers offer exposure to the sector’s fundamentals, while renewable energy stocks provide opportunities for investing in sustainable and environmentally conscious businesses.

In addition to the energy sector, technology stocks continue to be a favored choice among investors, driven by innovation, digital transformation, and strong earnings growth. Companies operating in sectors such as cloud computing, artificial intelligence, e-commerce, and cybersecurity are well-positioned to benefit from the ongoing tech revolution.

Amid the ongoing market trends, diversification remains a key strategy for investors to mitigate risk and maximize returns. By spreading investments across different sectors and asset classes, investors can reduce their exposure to sector-specific risks and capitalize on opportunities arising in various segments of the market.

In conclusion, equities are currently in a ‘go’ trend, with the energy sector standing out as a promising investment opportunity. By staying informed, conducting thorough research, and maintaining a diversified portfolio, investors can position themselves for success in the dynamic and ever-evolving equity markets.