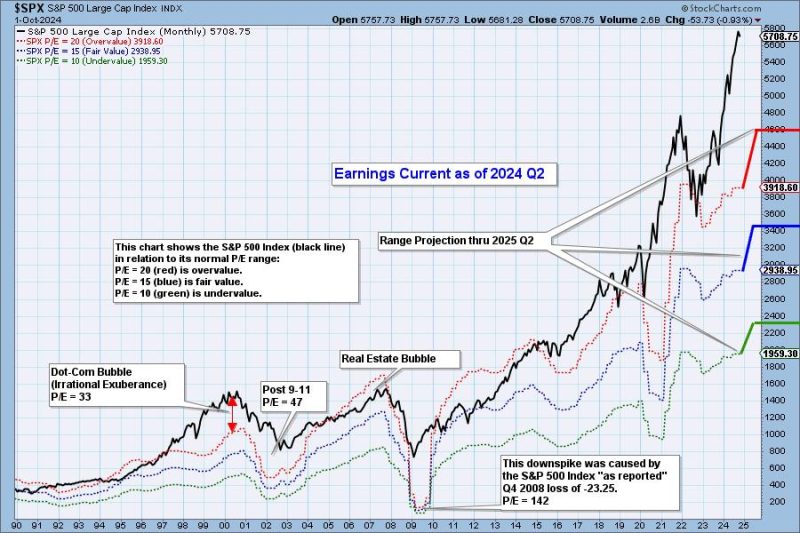

In a recent report published on godzillanewz.com, it was revealed that the market remains very overvalued based on the 2024 Q2 earnings. This development has raised concerns among investors and analysts alike, prompting a closer examination of the current state of the market.

First and foremost, the article highlights the disconnect between market valuations and actual corporate earnings. The Q2 earnings report indicates a mixed performance among companies, with some surpassing expectations while others faltered. Despite this, the overall market valuation continues to soar to unprecedented levels, leading to questions about the sustainability of such lofty levels.

Furthermore, the article delves into the impact of inflation on market valuations. The recent surge in inflation rates has put pressure on companies’ profit margins, leading to concerns about future earnings growth. This, in turn, has further fueled doubts about the justification for the current valuations in the market.

Moreover, the article discusses the role of interest rates in the current market scenario. With the Federal Reserve hinting at potential rate hikes in the near future, investors are bracing for increased borrowing costs and its potential impact on stock prices. This uncertainty has added to the existing concerns about the overvaluation of the market.

Another key point raised in the article is the influence of geopolitical events on market valuations. Factors such as global trade tensions, political instability, and the ongoing pandemic continue to weigh on investor sentiment, contributing to the volatility in the market.

In conclusion, the article paints a nuanced picture of the current state of the market, emphasizing the disconnect between valuations and corporate earnings, the impact of inflation and interest rates, and the influence of geopolitical events on investor sentiment. As investors navigate these uncertainties, it is crucial to exercise caution and undertake thorough analysis before making investment decisions in an increasingly overvalued market.