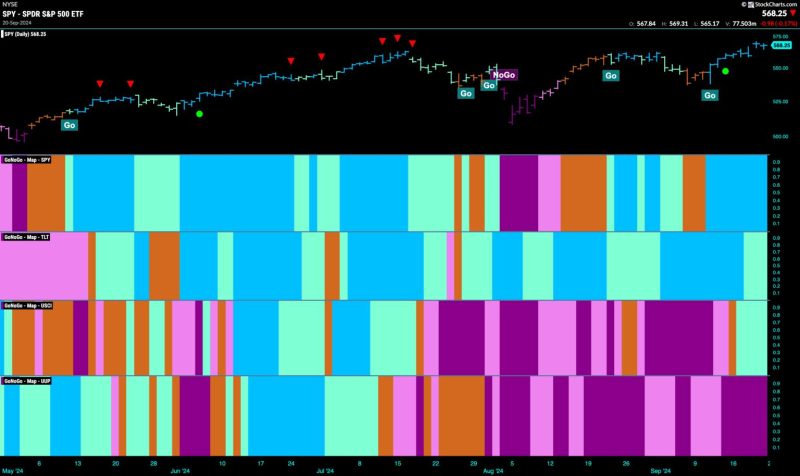

Equities Remain in Strong Go Trend Powered by Financials

The global equity markets continue to exhibit strength, buoyed primarily by the performance of the financial sector. Through a comprehensive analysis of market trends and key indicators, it becomes evident that equities are currently in a robust phase characterized by a clear go trend. This phenomenon is particularly pronounced in the financial segment, where several factors converge to drive market optimism and investor confidence.

One of the primary drivers behind the strong performance of financial equities is the overall health of the global economy. As economies around the world show signs of recovery and growth, financial institutions stand to benefit from increased demand for their services. With economic indicators pointing towards a favorable outlook, investors are optimistic about the future prospects of financial stocks, leading to a sustained uptrend in the sector.

Furthermore, the low interest rate environment prevalent in many parts of the world has been a significant tailwind for financial equities. Low interest rates reduce borrowing costs for businesses and individuals, spurring economic activity and driving demand for financial products such as loans and mortgages. This favorable interest rate environment has bolstered the profitability of financial institutions, translating into higher stock prices and improved investor sentiment.

Another factor contributing to the strength of financial equities is the increasing trend towards digitalization and innovation within the sector. Fintech companies and digital banks are disrupting traditional financial services, offering innovative solutions that cater to the evolving needs of consumers. As these companies continue to gain traction and expand their market presence, investors are drawn to the growth potential of such disruptors, further fueling the rally in financial equities.

Regulatory developments also play a crucial role in shaping the performance of financial stocks. Changes in regulations can have a significant impact on the operating environment for financial institutions, influencing their profitability and growth prospects. As regulatory frameworks evolve to address emerging risks and challenges in the financial sector, investors carefully monitor these developments to assess the implications for financial equities and adjust their portfolios accordingly.

In conclusion, the current strong go trend in equities, particularly in the financial sector, is underpinned by a combination of factors including economic growth, low interest rates, digitalization, and regulatory dynamics. As these factors converge to create a favorable environment for financial stocks, investors are presented with opportunities to capitalize on the continued rally in equities. By staying abreast of market trends and conducting thorough analysis, investors can navigate the evolving landscape of financial equities and position themselves strategically to benefit from the prevailing market dynamics.