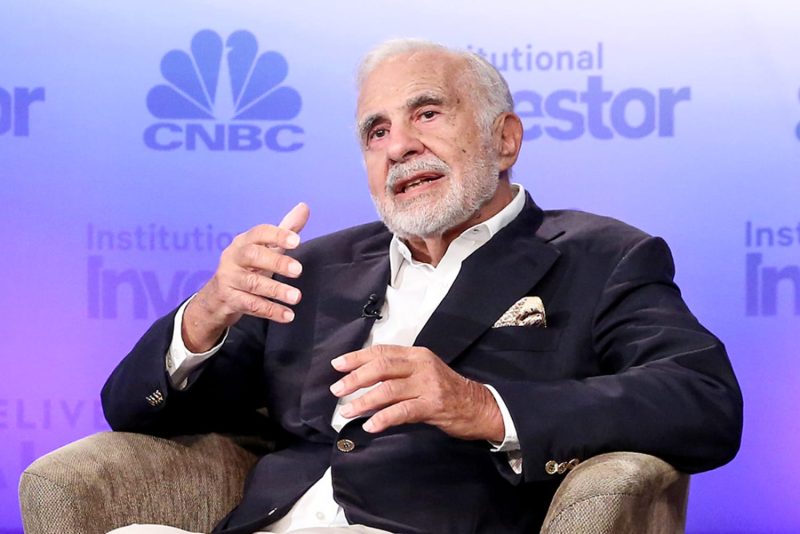

The recent news of the Securities and Exchange Commission (SEC) charging Carl Icahn with allegedly hiding billions of dollars worth of stock pledges has sent shockwaves through the financial world. The charges brought against the billionaire activist investor highlight the importance of transparency and honesty in the world of finance.

Icahn, a prominent figure in the investment community known for his outspoken views on corporate governance and shareholder activism, has long been a controversial figure. His aggressive tactics and bold investment strategies have garnered both praise and criticism over the years. However, the SEC’s allegations of deceptive practices have raised serious questions about his integrity and adherence to regulatory requirements.

According to the SEC, Icahn failed to disclose certain arrangements that allowed him to use his stock holdings as collateral for personal loans. By not reporting these stock pledges, Icahn allegedly deprived shareholders of vital information that could impact their investment decisions. The SEC contends that Icahn concealed billions of dollars in pledged shares, misleading investors and regulators in the process.

Stock pledges are common practices in the financial world, allowing investors to use their stock holdings as collateral for loans. However, the key issue lies in the transparency and disclosure of these arrangements. Failure to disclose such pledges can create a false impression of an investor’s financial position and intentions, which can have far-reaching consequences for the market and stakeholders involved.

The charges against Icahn serve as a reminder that no investor is above the law, and that transparency and compliance with regulatory requirements are fundamental principles of a fair and functioning market. The SEC plays a crucial role in enforcing these standards and holding individuals and entities accountable for their actions.

As the case unfolds, it will be interesting to see how Icahn responds to the allegations and what impact it may have on his reputation and business empire. Investors and analysts will be closely monitoring the developments, as the outcome of this case could have broader implications for the financial industry and regulatory landscape.

In conclusion, the SEC’s charges against Carl Icahn emphasize the importance of honesty, transparency, and compliance in the financial world. Upholding these principles is essential for maintaining trust and integrity in the markets, and any violation of these standards must be thoroughly investigated and addressed. The case serves as a cautionary tale for all investors and underscores the need for vigilance in upholding ethical and legal standards in the dynamic world of finance.