The recent market trends have seen some exciting movements in the Russell 2000 (IWM) and Retail (IYT) sectors, with NVDA also showing promising signs. In the world of investing, it is crucial to stay on top of market signals and trends in order to make informed decisions. Silver cross buy signals are indicators that should not be ignored, as they often point to potential opportunities for investors.

The Russell 2000, represented by the IWM ETF, has recently received a silver cross buy signal. This signal occurs when the 50-day moving average crosses above the 200-day moving average, indicating a potential upward trend. For investors tracking the small-cap sector, this signal could signal a buying opportunity in IWM.

Similarly, the Retail sector, as represented by the IYT ETF, has also received a silver cross buy signal. This sector encompasses a wide range of companies involved in retail, from traditional brick-and-mortar stores to e-commerce giants. The silver cross buy signal in IYT suggests that there may be positive momentum building in the retail industry.

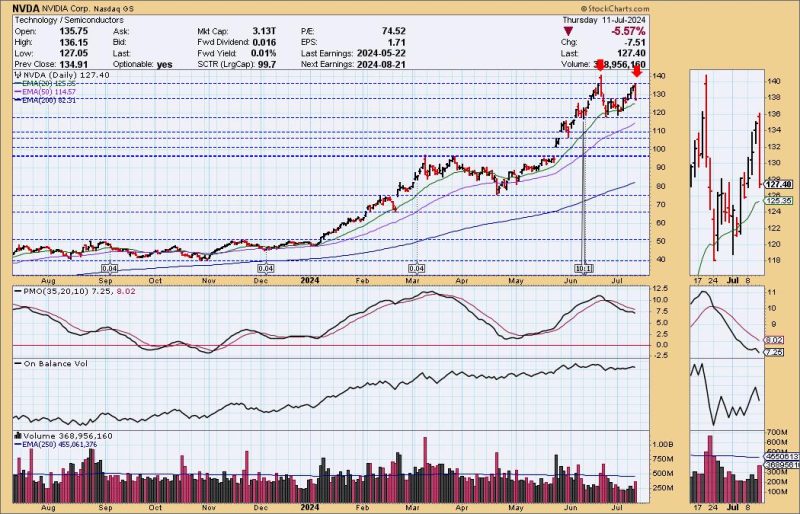

NVDA, the semiconductor giant, is another notable player that has seen a silver cross buy signal recently. As a key player in the technology sector, NVDA’s movements can have ripple effects across the market. The silver cross buy signal in NVDA indicates that there may be potential for growth in the semiconductor industry.

Investors should take note of these silver cross buy signals and consider how they align with their investment strategies. While these signals can be helpful indicators, it is essential to conduct thorough research and analysis before making any investment decisions.

In conclusion, silver cross buy signals in the Russell 2000 (IWM), Retail (IYT), and NVDA highlight potential opportunities for investors in these sectors. By staying informed and paying attention to market signals, investors can position themselves to take advantage of emerging trends in the market.