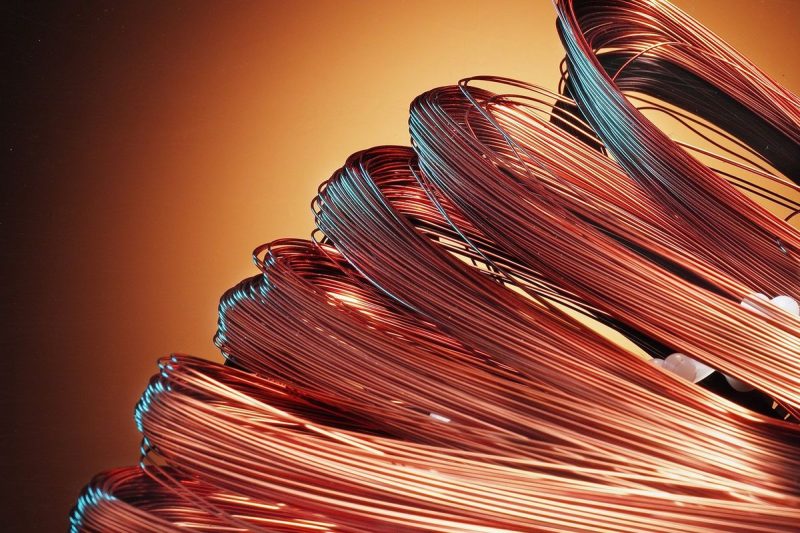

Investing in copper has gained popularity due to its essential role in various industries and its potential for growth as demand continues to increase. One way to gain exposure to the copper market is through Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs). In this article, we will explore six copper-focused ETFs and ETNs that investors can consider for their portfolios.

1. United States Copper Index Fund (CPER)

The United States Copper Index Fund (CPER) is designed to reflect the performance of copper by investing in a portfolio of exchange-traded copper futures contracts. This ETF provides investors with a convenient way to access the copper market without owning physical copper assets.

2. iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC)

The iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC) seeks to track the performance of copper futures contracts. This ETN offers exposure to copper prices and is a convenient way for investors to gain access to the copper market.

3. ProShares Ultra Bloomberg Copper (CPER)

The ProShares Ultra Bloomberg Copper (CPER) aims to provide double the daily performance of copper prices. This ETF is suitable for investors looking to amplify their exposure to copper and capitalize on short-term price movements in the copper market.

4. Aberdeen Standard Physical Copper Shares ETF (CUPM)

The Aberdeen Standard Physical Copper Shares ETF (CUPM) tracks the performance of physical copper held in secure storage facilities. Investing in this ETF provides investors with direct exposure to physical copper, offering a unique way to participate in the copper market.

5. iPath Series B Bloomberg Copper Subindex Total Return ETN (JJCB)

The iPath Series B Bloomberg Copper Subindex Total Return ETN (JJCB) is another copper-focused ETN that provides exposure to copper futures contracts. This ETN offers a way for investors to gain access to copper prices and potentially benefit from price movements in the copper market.

6. United States 12 Month Copper Index Fund (CPER)

The United States 12 Month Copper Index Fund (CPER) invests in a diversified portfolio of copper futures contracts to track the performance of copper prices. This ETF is suitable for investors seeking exposure to copper over a one-year period, offering a convenient way to invest in the copper market.

In conclusion, investing in copper can be a profitable venture given its importance in various industries and growing demand. By considering the above-mentioned copper-focused ETFs and ETNs, investors can gain exposure to the copper market and potentially benefit from its price movements. It is essential for investors to conduct thorough research and consult with financial advisors before adding copper investments to their portfolios.