The article you provided offers insights into the potential downside risks for stocks as value-oriented assets take the lead in the current market environment. While the article already covers essential points, here is a revised and expanded version for further elaboration:

1. Market Volatility Amid Value Shift

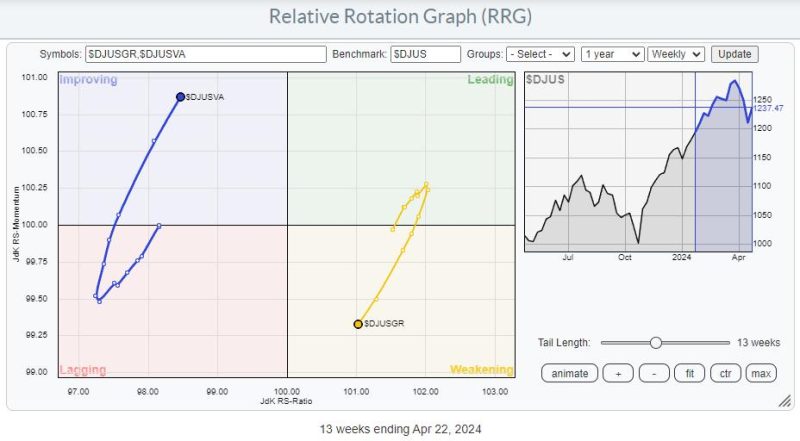

The current market landscape is witnessing a shift towards value stocks, leading to increased volatility. Historically, value stocks have seen periods of outperformance followed by periods of underperformance. Investors need to be cautious as the momentum swings towards these types of equities, potentially signaling a bumpy road ahead.

2. Inflation Concerns and Interest Rate Hikes

Rising inflation concerns and the possibility of interest rate hikes pose significant risks to stock valuations. As central banks consider tightening monetary policy to combat inflation, equity markets could experience downward pressure. Investors must closely monitor economic indicators and the actions of regulatory bodies to gauge the impact on stock performance.

3. Global Economic Uncertainty

The interconnected nature of the global economy exposes stocks to various international risks. Geopolitical tensions, trade disputes, and economic disparities across regions can impact stock prices. Diversification across different asset classes and geographies can help mitigate risks associated with global economic uncertainty.

4. Regulatory Changes and Policy Shifts

Changes in regulations and government policies can have a profound impact on stock markets. Industries sensitive to regulatory shifts, such as healthcare, energy, and technology, may experience heightened volatility. Investors should stay informed about legislative developments and adjust their portfolios accordingly to navigate potential risks.

5. Technological Disruptions and Innovation

The rapid pace of technological advancements presents both opportunities and risks for stock investors. Disruptive technologies and innovation can drive market shifts, creating winners and losers among stocks. Companies that fail to adapt to technological changes may face declining stock prices, underscoring the importance of staying abreast of industry trends.

6. Earnings Uncertainty and Corporate Performance

Stock valuations are closely tied to corporate earnings, making earnings reports a critical factor for investors. Uncertainty surrounding future earnings projections can lead to stock price fluctuations. Monitoring company performance and financial health is essential to assess the potential downside risks associated with individual stocks.

7. Psychological Factors and Market Sentiment

Psychological factors, such as investor sentiment and market psychology, play a significant role in stock market movements. Sentiment shifts driven by fear, greed, or market euphoria can influence stock prices beyond fundamental analysis. Investor emotions can exacerbate downside risks during periods of market turbulence, underscoring the importance of maintaining a disciplined investment approach.

8. Black Swan Events and Systemic Risks

Black swan events, rare and unforeseen occurrences with extreme consequences, pose systemic risks to stock markets. Events like natural disasters, global pandemics, or financial crises can trigger market-wide sell-offs and volatility. Diversification, risk management strategies, and contingency planning are essential to mitigate the impact of black swan events on investment portfolios.

9. Behavioral Biases and Investment Pitfalls

Investors are susceptible to behavioral biases and cognitive errors that can lead to suboptimal investment decisions. Overconfidence, herd mentality, and anchoring biases can distort perceptions of risk and return, potentially exposing portfolios to unnecessary risks. Understanding one’s behavioral tendencies and practicing disciplined decision-making can help mitigate investment pitfalls.

10. Long-Term Perspective and Risk Management

Navigating downside risks in the stock market requires a long-term perspective and effective risk management strategies. Diversification, asset allocation, and periodic portfolio rebalancing are key principles to reduce exposure to market vulnerabilities. By maintaining a balanced investment approach and staying informed about market dynamics, investors can better prepare for potential risks and uncertainties in the stock market.

In conclusion, while the current environment presents downside risks for stocks as value takes the lead, proactive risk assessment, disciplined investing, and strategic decision-making can help investors navigate challenges and optimize portfolio performance in the ever-changing market landscape.