The recent news about the plunge in media shares following the filing to issue additional DJT stock by Trump Media is significant in the realm of financial markets and media industry dynamics. The implications of such a move by Trump Media can have wide-ranging effects on shareholder value, market sentiment, and the overall landscape of media ownership. By delving deeper into this development, we can gain insights into the complexities and nuances of the media business in the modern age.

First and foremost, the decision of Trump Media to file for issuing additional DJT stock hints at the company’s strategy to raise capital or drive expansion initiatives. Issuing additional stock can be a way for companies to infuse cash into their operations, pursue acquisitions, or fund new ventures. However, the market’s reaction to such a move can be telling, as investors may interpret it as diluting their ownership stake or signal potential financial challenges within the company.

In the case of media shares plunging after this announcement, it suggests that investors and market participants have concerns or reservations about Trump Media’s plans. The media industry is highly competitive and rapidly evolving, with companies vying for audience attention, advertising dollars, and strategic partnerships. Any significant move by a major player like Trump Media can spark reactions across the sector, reflecting the interconnectivity and interdependence of media companies in today’s digital ecosystem.

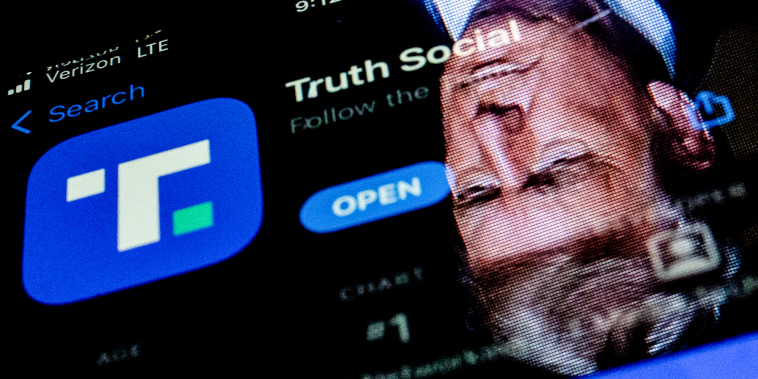

Moreover, the influence of political figures like Donald Trump on the media landscape adds another layer of complexity to this development. Trump’s foray into creating his media platform has been closely watched and scrutinized, given his background as a public figure and his contentious relationship with mainstream media outlets. The intertwining of politics, media, and finance underscores the need for transparency, accountability, and strategic foresight in navigating the complexities of these intersecting domains.

As media shares continue to fluctuate in response to evolving market conditions and corporate decisions, it is essential for investors and industry observers to stay informed and discerning. The impact of Trump Media’s stock issuance filing serves as a reminder of the dynamic nature of the media business, where strategic moves and market forces intersect to shape the future trajectory of the industry.

In conclusion, the plunge in media shares following Trump Media’s filing to issue additional DJT stock underscores the interconnectedness of financial markets, media dynamics, and political influences. This development highlights the need for vigilance, analysis, and adaptability in navigating the complexities of the media landscape in an era of rapid technological advancements and shifting consumer preferences. As the saga of Trump Media unfolds, stakeholders across the media industry will be closely monitoring the implications of this move on shareholder value, market sentiment, and the competitive dynamics of the sector.